Prime Minister Mateusz Morawiecki announces new Treasury bonds that will help protect Poles against inflation

11.05.2022

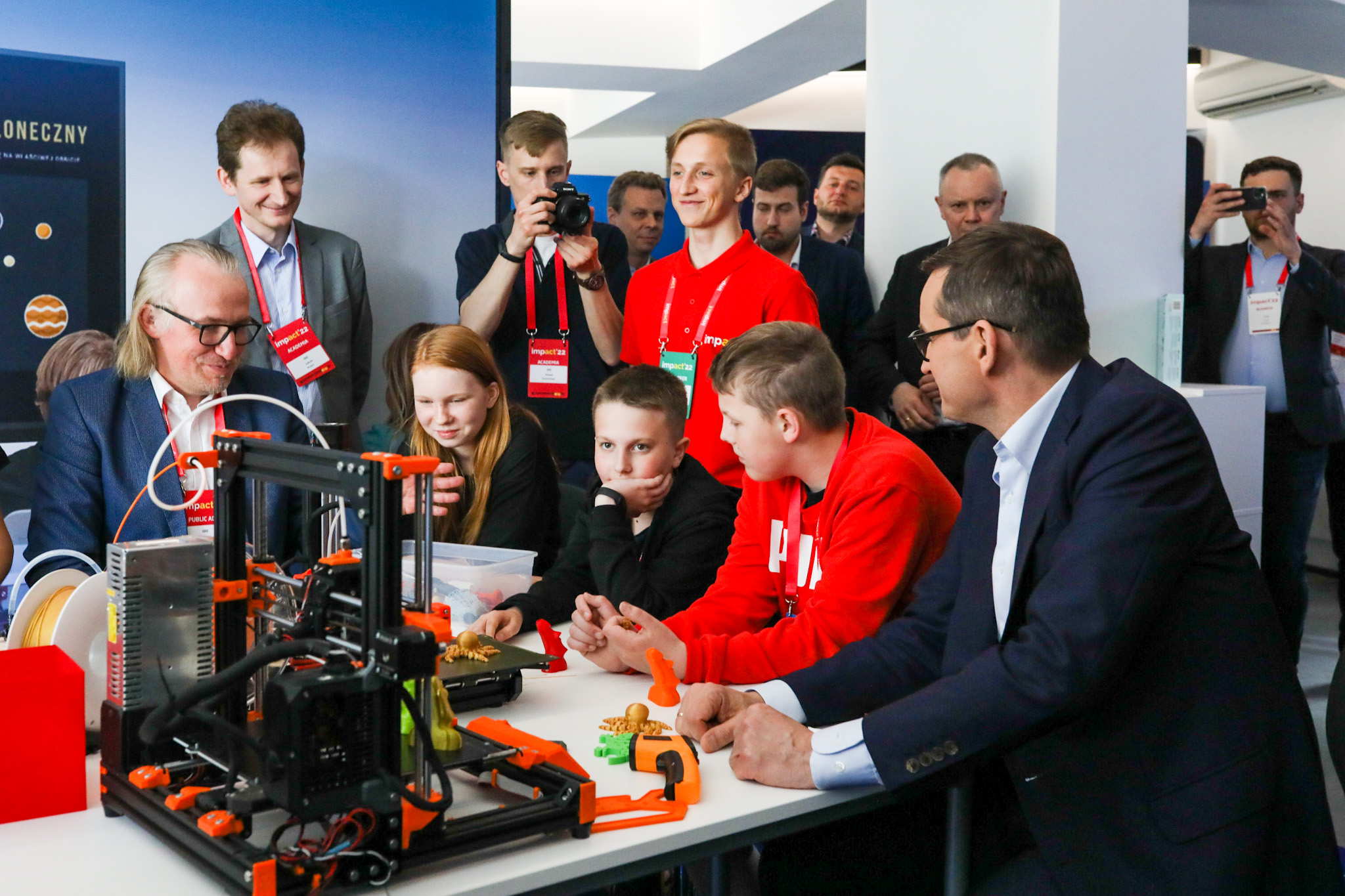

The head of the Polish government took part in the Impact’22 congress. In his speech, he drew attention to the unprecedented challenges that we are facing. We are struggling with the effects of the pandemic and interrupted supply chains as well as the consequences of the war in Ukraine. Access to raw materials and inflation also play a huge role. Therefore, in order to meet the needs of Poles, the Prime Minister announced new Treasury bonds. It is a safe and beneficial solution that protects our savings.

- Even the best innovator in the world, with great promising startups, cannot disregard the great challenges that we are facing today - emphasized the prime minister.

Challenges for Europe

- Gigantic geopolitical challenges have added to the pandemic, the broken supply chains, the problems on the raw material markets, and the inflation - pointed out the head of the Polish government. It entails actions that must be taken by the whole Europe. Reconstruction of production chains and the maximum possible independence in the supply of raw materials are among the postulates made during the conference.

The entire continent is affected by the record inflation. When we introduced the Anti-Inflation Shield at the beginning of the year, the first effects did not take long to come - inflation was restrained. The geopolitical situation was influenced by Russia's brutal attack on Ukraine. People are killed every day behind our eastern border, and the economic consequences of the invasion are experienced by all of Europe.

Relief for borrowers

We do not remain passive and introduce solutions that mitigate the effects of inflation felt by Poles. As part of the Anti-Putin Shield, we propose new solutions for borrowers. Loan holidays or loan subsidies for people who have lost their jobs - these are just some of the proposals that we are currently consulting with the public.

Find out more about support for borrowers

Treasury bonds protect the savings of Poles

We are also introducing two new types of savings bonds - one-year and two-year bonds - based on the reference rate of the National Bank of Poland. Floating interest rates will protect Poles' savings against the effects of inflation.

- These will include new one-year bonds at the level of the Central Bank's reference rate, which today amounts to 5.25, but also higher anti-inflationary bonds, which have already been introduced - announced the Prime Minister.

The bonds will be available for sale starting from June. People can buy them in almost 1,600 bank branches (PKO BP and PEKAO SA), but also over the phone and the Internet. A bond account for natural persons shall be maintained free of charge. It is a safe and accessible solution that will enable the protection of Pole’s savings.

What are bonds?

They are securities sold by the Minister of Finance on behalf of the State Treasury. Through the sale of bonds, the minister borrows a certain amount of money from the buyer. They are obliged to return that amount with interest, i.e. to redeem the bonds within a specified period of time.

The State Treasury guarantees the redemption of bonds and the payment of interest with its assets. This is why the Treasury bonds are one of the safest forms of saving.