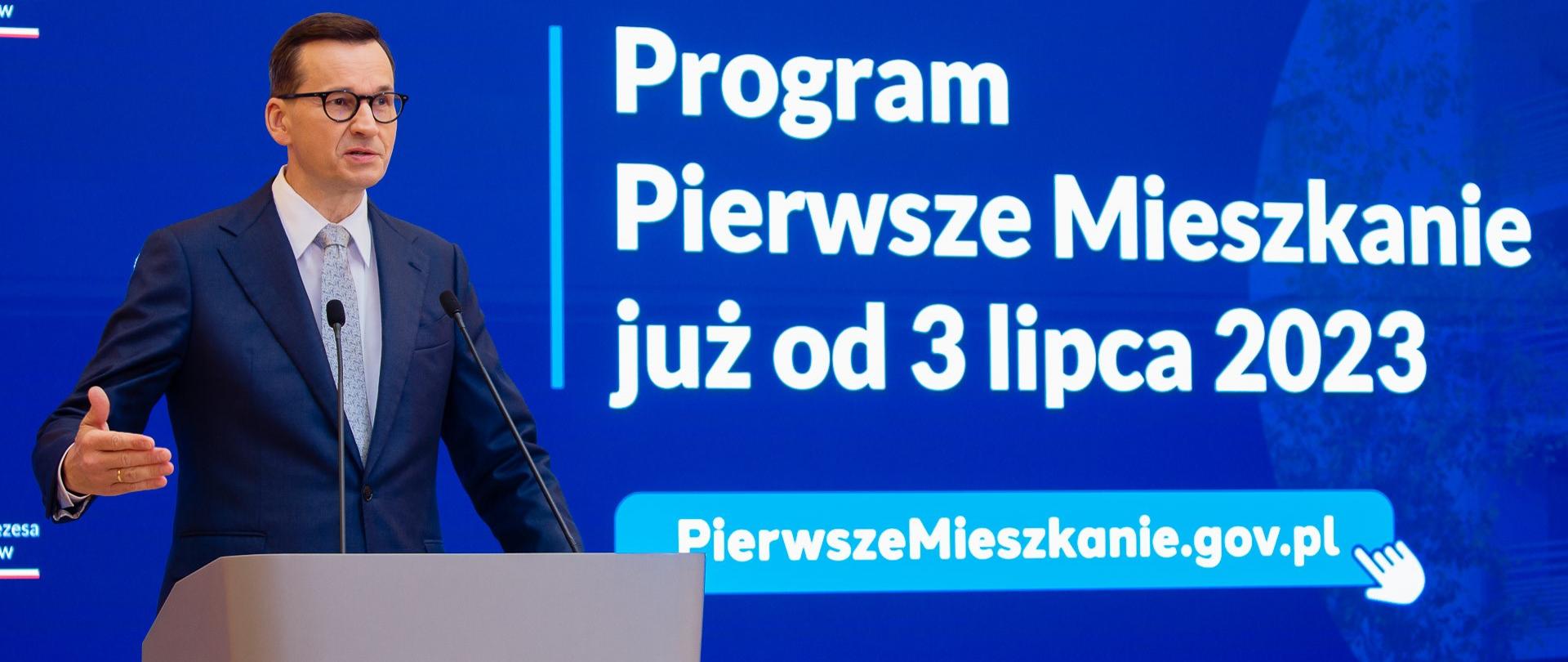

2% Safe Mortgage and Home Savings Account now available to Poles

03.07.2023

The government's First Home Programme has been launched! Anyone who wants or plans to buy their first property can benefit from a 2% Safe Mortgage and a Home Savings Account. The new measures are a real help and a breakthrough in thinking about state aid to meet the housing needs of Poles. The programme is aimed at people under the age of 45 who have not previously owned their own flat or house. The 2% Safe Mortgage allows them to take out a loan with a fixed interest rate of 2% over 10 years. The Home Savings Account is an opportunity to save with a bonus from the state. At the same time, many other government programmes tailored to different needs are already in place.

First Home Programme

We want to help Poles buy their first flat or house. We have prepared specific measures – this is a breakthrough in meeting the housing needs of Poles.

- 2% Safe Mortgage - for those who already want to buy a flat or house

- Home Savings Account - for those who are still just planning the purchase and collecting savings

“Supporting young families in starting life in their own home is absolutely fundamental for us,” stressed Prime Minister Mateusz Morawiecki during a press conference. “I would like young people to be able to devote their energy first and foremost to their education, work, private life, professional life, and not to issues related to housing, to the amount of instalments,” said the head of government.

2% Safe Mortgage

This is the government's mortgage subsidy scheme. It will ensure that the mortgage has a fixed interest rate of 2% for the first 10 years.

“Above all, we want this new idea of ours to serve stability and predictability. We call it a safe mortgage, because it has a safe fixed interest rate, regardless of whether it grows again in 5 years or in 10 years," stressed Prime Minister Mateusz Morawiecki.

The maximum amount of the 2% Safe Mortgage is:

- PLN 500,000 for one person

- PLN 600,000 for a married couple or parents with a child

The mortgage can be obtained for flats from both the primary and secondary markets. The procedures for taking out the 2% Safe Mortgage are as simple as possible. There are no restrictions on the standard or location of the property. The programme is can be used until 2027 (with the possibility of extension).

The 2% Safe Mortgage is a standard mortgage provided by commercial banks. The difference is a subsidy from the state for the first 120 instalments of the mortgage. Within the framework of the "Housing without own contribution" programme, it is also possible to grant the 2% Safe Mortgage to people who have not accumulated the funds for their own contribution.

Home Savings Account

Those planning a purchase in the next few years can save using the Home Savings Account, which guarantees the receipt of a savings bonus from the state.

The account can be opened from the age of 13 to 45 – in this way, parents can ensure a secure future for their children by opening a Home Savings Account even before they reach the age of majority.

“We want this stability, predictability to be the fundamental feature of this programme,” said Prime Minister Mateusz Morawiecki. “I will do my best to fight with all my might for the best possible conditions on the housing market for all Poles, and in particular for young Poles who need housing the most when they decide to start a family and have children,” emphasised the head of government.

For more information on the new First Home Programme, please visit pierwszemieszkanie.gov.pl.

Housing support – government programmes tailored to different needs

At the same time, we offer a number of other government support programmes, facilitating construction or purchase of property, which include:

- “Home without formalities”,

- Social and Communal Housing Programme,

- "Housing without own contribution",

- “Starter home”,

- Housing cooperatives.

“Today, in social policy, we do not have to start from scratch. In the last eight years there has been a great boost in resources to improve the lives of different social groups,” said the Prime Minister and pointed out that various housing and construction support has already been implemented for several years.

It is also still possible to take advantage of mortgage payment holidays, which allow you to freeze one mortgage payment per quarter until the end of 2023. This is a relief for the wallets of Polish people who are already in the process of paying off their mortgage. Since July 2022, more than one million mortgages have already benefited from credit holidays.