Higher pensions, additional benefits and a lower retirement age - we take care of our seniors

02.01.2023

We know that pensioners deserve better, which is why we have been consistently developing our senior policy. So far, we have made many important improvements - we have rolled back the harmful pension age reform, introduced end-of-year bonuses (13th and 14th pension), added a tax-free pension and PIT-0 for working seniors. From 1 March 2023, the minimum pension will be as high as PLN 1,588.44 - a record 77% increase compared to 2015. This is also a benefit increase of at least PLN 250 (no less than 13.8 per cent). In parallel, we have developed a number of activation programmes for seniors. Social solidarity is a value we understand.

Retirement is a right, not an obligation

One of the key changes that the government introduced on 1 October 2017 was the restoration of the previous retirement age - 60 for women and 65 for men. We were able to do this thanks to a responsible fiscal policy, the fight against VAT mafias and the elimination of loopholes in the tax system.

According to a CBOS survey, as many as 84 per cent of Poles was in favour of returning to the previous retirement age (survey conducted during the legislative work on the law restoring the retirement age).

We fulfilled our promise to citizens and met the expectations of Poles. The obligation to work until the age of 67 meant less time for grandchildren, family or health. The higher retirement age also affected farmers.

Higher benefits from March 2023

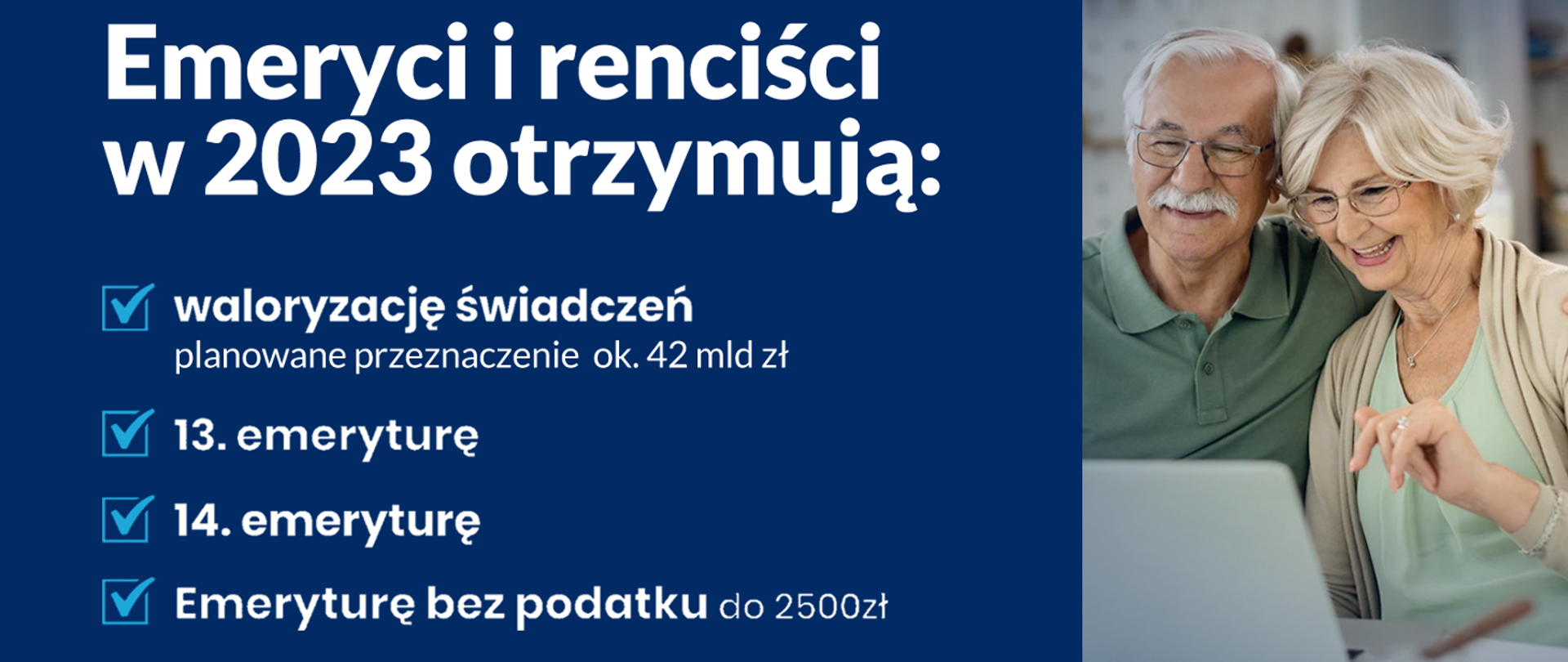

In 2015, the minimum pension was just over PLN 750 net. We forecast that in 2023 - taking into account the 13th and 14th pension and an indexation of 13.8 – it will amount to PLN 1,648 net. Thanks to lower taxes, this is an increase of nearly 118 per cent (for the net amount).

Additional benefits in the form of the 13th and 14th pension are also a solution we have introduced to make life better for seniors. The government plans to pay these benefits in 2023 as well.

In parallel, many pensioners have been granted a tax-free pension - the tax-free amount increased to PLN 30,000 in 2022. Thanks to this solution, nearly 70% of pensioners will stop paying tax. Pensioners with higher benefits will only pay tax on the amount exceeding PLN 2,500. In addition, there is a tax relief (PIT-0) for working seniors after reaching retirement age.

Social programmes for seniors

An important part of senior policy is to support the broadly active elderly. We have taken the initiative and implemented programmes such as “Senior+” and “Active+” (“Aktywni+). These provide funding for day care centres and senior centres and for the organisation of recreational and cultural activities.

Health is an important part of supporting seniors - hence our next “75+ Medicine” (“Leki 75+”) programme. Since September 2016, all people aged 75 and over can benefit from free medicines. Their list is gradually being expanded. To date, 3.7 million seniors have already benefited from the programme.

We do not forget about people who are less independent. The “75+ Care” (“Opieka 75+) programme, which has been in operation since 2018, supports local authorities in providing care services, including specialised ones for people aged 75 and above. Also in 2022, the “Senior Support Corps” (“Korpus Wsparcia Seniorów”), launched during the pandemic, was operational.