Polish Deal to bring stabilisation, increased local government income and numerous new investment projects across Poland

18.08.2021

For years, the effective actions of our government have contributed to the improvement of local government units’ financial position. Increased local government income, new investment projects and income stabilisation are just some of the beneficial changes that will be brought about by the Polish Deal programme. During his visit to Lower Silesia, Prime Minister Mateusz Morawiecki presented further details on the programme’s new solutions. Among them is the Polish Deal for Local Governments. The government will prepare an act under which PLN 8 billion will be transferred to Poland’s local governments for their next year’s expenses. All LGUs will receive support under the act and will be able to use the extra funding for investment projects improving the citizens’ quality of life, including road, schoolhouse and playground construction projects.

Polish Deal for Local Governments

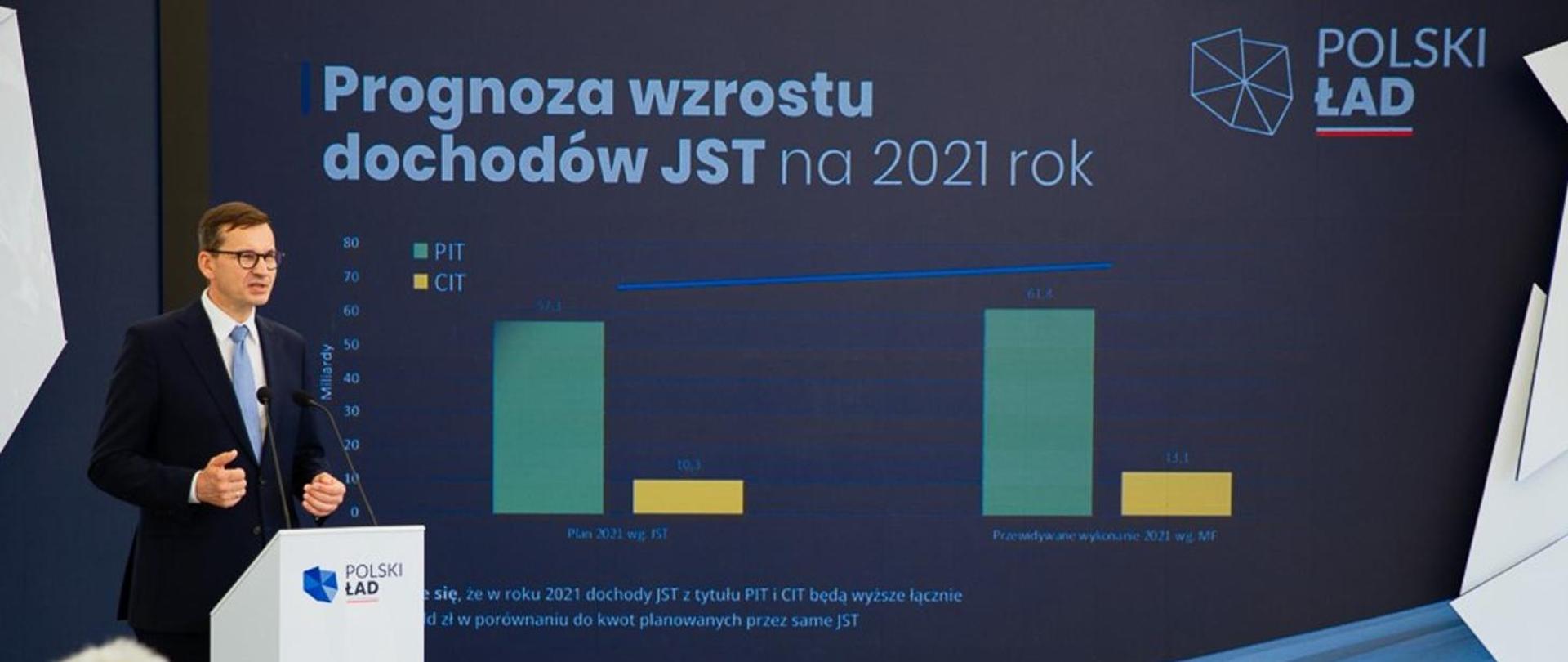

“The Polish Deal and consolidated public finances not only bring money for major social and infrastructural programmes but also for the stabilisation and improvement of local government income”, PM Morawiecki explained.

Following the introduction of the Polish Deal and solutions to stabilise and bolster LGU finances, in 2022, local governments will generate PIT, CIT and general subsidy income at a level of about PLN 146 billion. This income will be 4.3% higher than the forecasts of the LGUs themselves. Taking into account the investment funding provided under the Polish Deal Fund, the income increase for LGUs will amount to 9.6%.

Local government units to gain increased income

The government has been supporting Poland’s local governments for many years. Compared to the 2011-2016 period, the financial position of LGUs has vastly improved over the last several years, particularly in the 2016-2020 period.

The total 2016-2020 income amounts to PLN 1.3 billion, which is a nearly 40% increase compared to that in the 2011-2015 period. There has been an increase in all income categories:

- PLN 161 billion more of own income,

- PLN 40 billion more subsidies,

- PLN 152 billion more as part of targeted subsidies.

The government’s actions have enabled a dynamic increase in the local governments’ investment capacity, with the latter’s budget operating results improving by over 50%. Effective action makes it possible to implement public tasks, which further increases the investment potential of individual local governments.

Local government finances during the COVID-19 pandemic

Efficient and effective action by our government has made it possible to safeguard financial liquidity and jobs in many Polish companies, positively affecting local governments at the same time. Thanks to this, LGUs attained the planned pre-pandemic revenue levels, closing the year 2020 with a budget surplus of PLN 5.7 billion (despite an expected deficit of over PLN 20 billion).

“You also have to look at the opening balance. Thanks to the Financial Shield and Local Government Shield programmes, local governments closed the year 2020 in positive territory with a 5.7 billion surplus despite the earlier concerns. By the end of this half of 2021, this surplus has increased to 22 billion. We will add another PLN 8 billion to that, plus detailed solutions beneficial for local governments. The financial buffer for 2022 will be very good. This is the first pillar of the Polish Deal”, said Prime Minister Mateusz Morawiecki.

Government assistance includes transferring more than PLN 13 billion of additional investment funding under the Governmental Fund for Local Investments, as well as making local government budgets more flexible.

Polish Deal for Local Governments – three basic pillars

First pillar – stabilising current income

“The Polish Deal for Local Governments consists of three basic pillars. The first one is stabilising current income. To assist in that, within two weeks the government will prepare an act under which PLN 8 billion will be transferred over in the fourth quarter to support next year's expenses – to stabilise the expenses of local governments”, PM Morawiecki remarked.

Local governments will decide for themselves what to spend the extra funding on. As emphasized by the Prime Minister, the algorithm will be fair for all local governments as it will take into account the income differences between more and less affluent municipalities, cities and counties. Due to this change, current revenues for local governments will be higher next year than those forecast on 5 May 2021.

Second pillar – further income stabilisation

The second pillar presented by Prime Minister Mateusz Morawiecki is the further stabilisation of income. “We have presented the 1/12 stabilisation mechanism. Income will be planned in such a way as to be received by the local governments in a predictable fashion. Local government officials have been calling for that for a long time. We are introducing appropriate mechanisms for fiscal rules and classifying investment projects executed with the support of EU funding, so that this rule brings a dynamic increase in current expenditure, and particularly, investment project expenditure”, said Mr Morawiecki.

Implementing solutions stabilising and strengthening LGU finances:

- target-based: certain, predictable PIT and CIT revenues for LGUs; an income rule ensuring long-term financial stability for LGUs; an equalisation system based on the current year income;

- pro-investment: new development (investment) subsidy; funds from the Polish Deal Government Fund;

- transitional: modifying fiscal rules to increase the flexibility of LGU budget management; supporting LGUs in 2021 with PLN 8 billion in additional funding for the implementation of their 2022 tasks.

Desired stabilising solutions

- guaranteed PIT and CIT income level for LGUs, at least at the same level as of the previous year – income guarantee for local governments;

- introducing a local government income stabilisation rule – local government income will be less susceptible to business cycle fluctuations and more resistant to the effects of legal changes;

- simplifying the so-called “Robin Hood tax system” (Pol.: “janosikowe”) and using the current year income as the point of reference – adjusting the system to better match the current financial situation.

Third pillar – development and investment projects

“The third pillar is focused on development and investment projects. It is an investment project subsidy that local governments will receive each year until further notice, which we can set aside thanks to the improved stability of public finances. After July, we already have a PLN 30 billion surplus. Our meticulous work – primarily in terms of fighting tax crimes and sealing the tax system – has led to the tightening of public finances. Thanks to this, today, we can offer to local government officials the Polish Deal for Local Governments comprising these three sources of funding”, said Prime Minister Mateusz Morawiecki.

Pro-investment project solutions:

- Introduction of a new portion of the general subsidy – the development portion:

- constant support for LGUs in the area of investment projects;

- subsidies are to be determined based on an objective algorithm, taking into account the LGU capital expenditure level and the number of inhabitants.

- Polish Deal Government Fund: Strategic Investment Project Programme:

- increasing the scale of public investment projects through non-returnable co-financing;

- investment project loan commitments issued by Bank Gospodarstwa Krajowego;

- subsidies amounting to 80-95% of the given task’s value.

Under the Strategic Investment Project Programme, tens of billions of zlotys will be made available for critical investment projects throughout Poland. This funding will allow local governments to implement road and railway construction, as well as cultural investment projects.