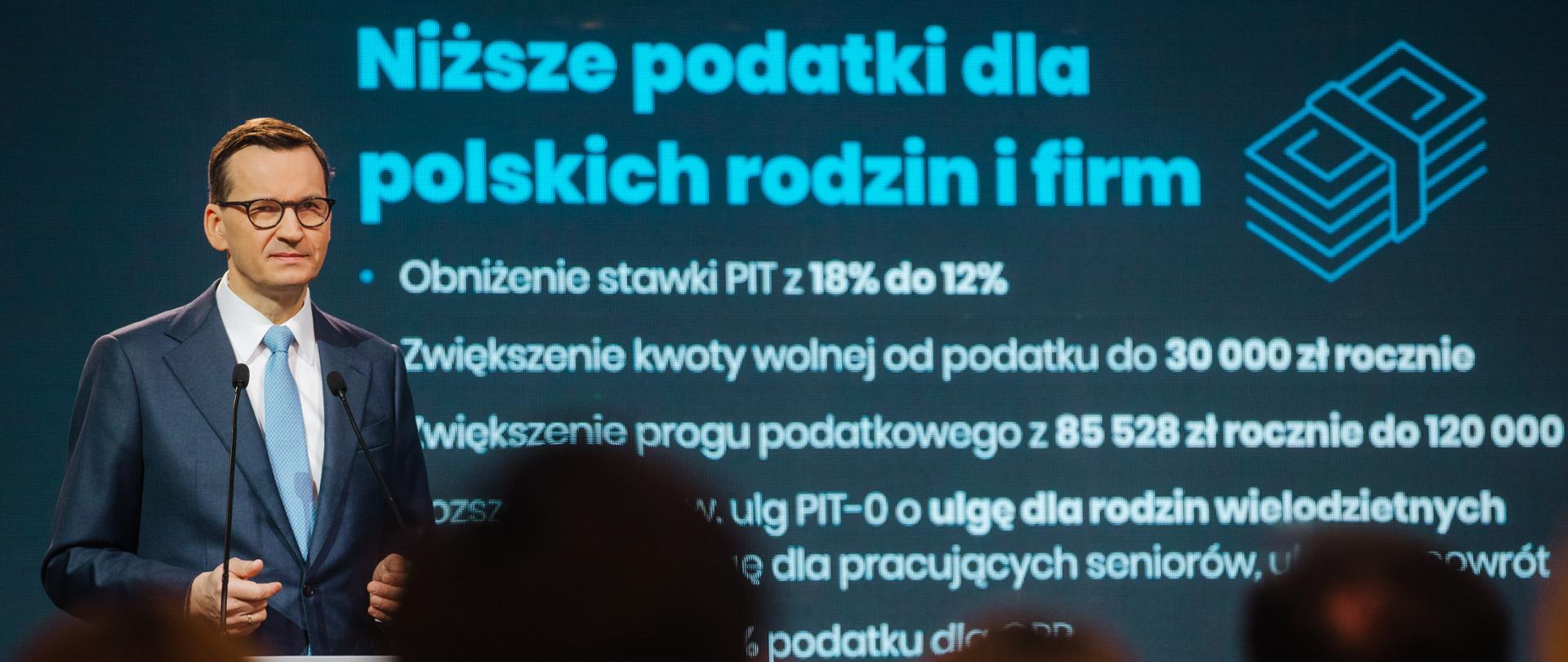

Prime Minister Mateusz Morawiecki: we have a very stable public finance situation

06.03.2023

We ensure a balanced budget and public finances. Thanks to efficient management and innovative tools, we are at the forefront of the European Union countries that are reducing the VAT gap the fastest. Between 2016 and 2022, VAT revenue increased from PLN 123.1 billion to PLN 230.5 billion, and we anticipate a further increase to PLN 286.3 billion in 2023 - a whopping 132.5 per cent. Since 2016, we have also seen a rapid increase in CIT tax revenue - next year we estimate it will be PLN 95.4 billion. This is despite the reduction of the CIT rate and the introduction of a number of tax reliefs for entrepreneurs.

Quality in public finance management

Despite crises such as the pandemic, Russia's attack on Ukraine and the economic consequences of these events, state budget revenues from PIT and CIT are increasing. This is possible thanks to the effective fight against VAT mafias and the tightening of the tax system. Since 2017, the National Revenue Administration has been in place, which, among other things, has helped to reduce the shadow economy.

“The quality of public finance management translates into the quality of the lives of all citizens: into social policy, the ability to purchase armaments - which is, after all, fundamentally important for our sovereignty today - into development programmes, support for local governments, major infrastructure programmes - local, district, voivodeship and national roads, as well as into a sharp increase in spending on health care - as part of a huge social spending programme,” pointed out the head of the Polish government.

Additional funding for social and investment programmes

We manage public finances with a view to best supporting Poles. The money raised from PIT and CIT means more money for social and investment programmes, anti-crisis shields and additional support for both Poles and local governments. We do not limit the support that flows to citizens, even at the cost of reduced budget revenues. A good example is the projected increased revenue from PIT while maintaining a “zero” VAT rate on food in 2023. Local governments are also benefiting from the increase in CIT revenues, with nearly one-quarter of this tax going to them.

“This happened thanks to our huge support programmes, which reached probably everyone in the population in 2022 through the reduction of VAT on all basic foodstuffs to zero - a reduction which we are maintaining in 2023 through the reduction of VAT on fuels, on gas, on heat energy, on electricity, the reduction of excise tax - after all, this was a great loss in public finances,” stressed the Prime Minister when talking about the budget deficit, which will be around 3%. It is significantly lower than what was forecast just a few months ago.

Continued support for entrepreneurs

CIT is a tax on corporate income, i.e. on companies. From 2016 to 2023 (according to forecasts), the projected increase in tax revenue from CIT is 190%. This is in spite of continued support for entrepreneurs, which lowers state revenues. We support the development of small and medium-sized Polish companies, which can benefit from a reduced tax rate. CIT has de facto become a tax on large multinational corporations.

We support entrepreneurs through measures such as:

- reduction of CIT for small taxpayers to 9% from 19%, which was still in force in 2017;

- increasing the limit for applying the 9% CIT rate from EUR 1.2 to EUR 2 million in revenue;

- introducing the option to benefit from Estonian CIT and a number of tax reliefs, e.g. IP Box, R&D relief or innovative employees relief.