The Prime Minister: The Council of Ministers has adopted an ambitious budget for difficult times. This is the budget of the security of Poland and Polish families

30.08.2022

Russia’s brutal act of aggression on Ukraine, the increase in the costs of raw materials, and the COVID-19 pandemic have negatively affected the economy of many countries throughout the world. In this difficult period, the government supports the Polish citizens, among others, by lowering taxes or the implementation of the Government Anti-Inflation Shield. It is possible, among others, due to the effective sealing of the taxation system. In spite of the crisis faced by the entire world, the condition of the Polish economy is stable. The Council of Ministers has adopted an outline financial law for 2023. It foresees that in the next year, the revenues in the national budget are going to increase to approximately PLN 604.4 billion. In comparison to 2015, that is an increase of nearly 110%.

The outline law is going to be sent for consultations under the Social Dialogue Council. The final draft budget is going to be adopted by the government by the end of September.

– Under this budget, we have made numerous assumptions, expenditures aimed at ensuring the safety of Polish families during this difficult period under our administration. Which means the war in the Ukraine – said Prime Minister Mateusz Morawiecki.

The head of the government underlined, that the high inflation is caused by factors such as the war behind the eastern border of our country, tensions at the energy raw materials market and the COVID-19 pandemic.

– This is the environment we operate in, and based on the assumptions of various international institutions and our own analyses, we have reached a certain specific macroeconomic parameter, and subsequently based budget assumptions on them – emphasized the prime minister.

Effective sealing of the tax system

The government consequentially increases budgetary revenue, which allows to implement a number of projects aimed at Polish citizens.

- The planned revenues to the state budget in 2023 are going to amount to PLN 604.4 billion. In 2015, the amount was PLN 289.1 billion. This is an increase of nearly 110 percent.

- The increase in revenue is primarily caused by the effective sealing of the tax system. In 2015, the VAT gap amounted to 24.2 percent. In 2021, it amounted to 4.3 percent. This is a decrease by 83 percent and PLN 47 billion more in the state budget under the circumstances in 2021.

- If it was not for the liquidation of the VAT gap, the expenditures in this year’s budget would be lower by PLN 50 billion. This is more than the joint expenditures on the Family 500+, Good Start and the Family Care Capital programmes.

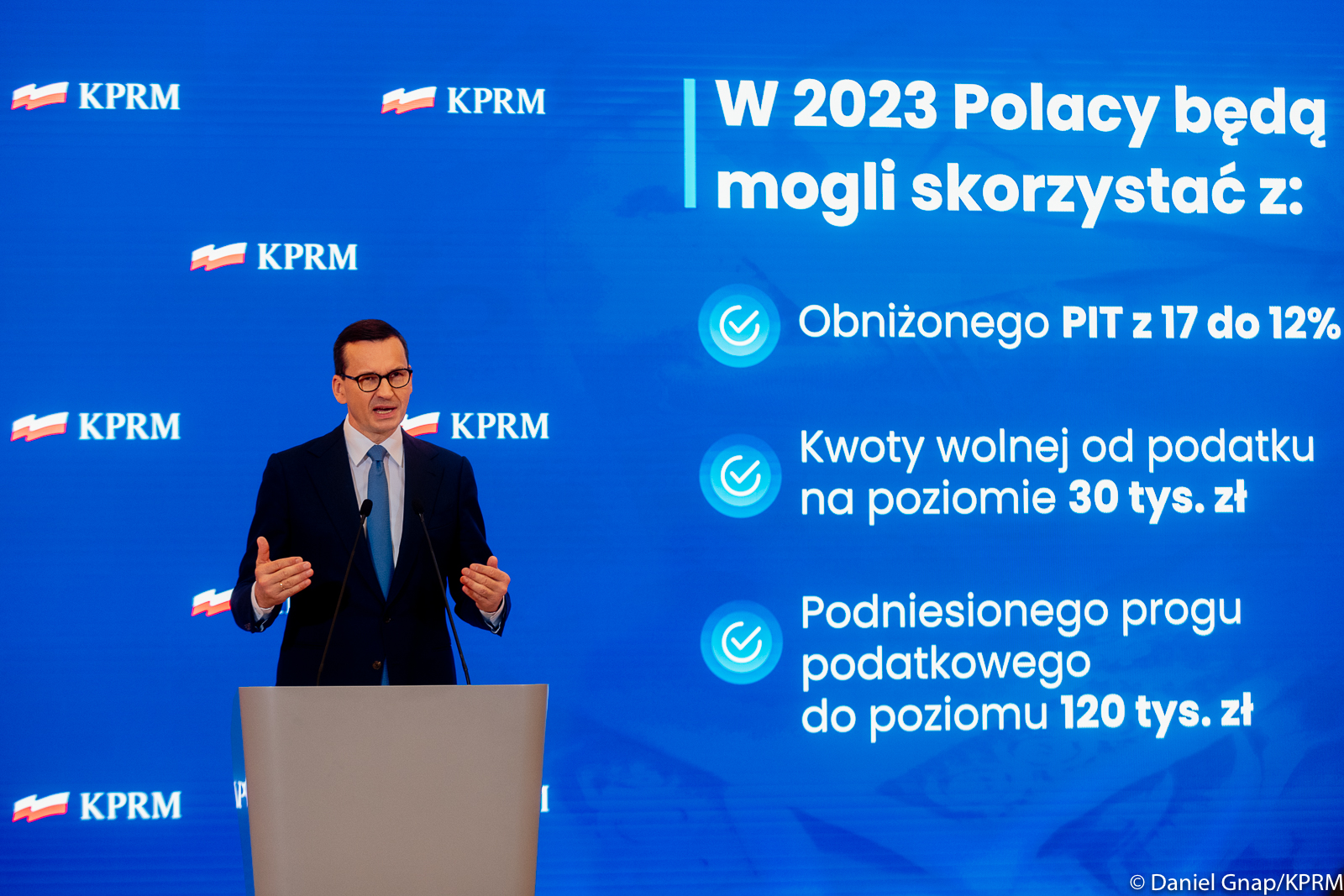

Lower taxes and government support in the difficult time

The government wants more savings to remain in the pockets of Polish citizens. Which is why it continues to systematically lower taxes:

- PIT decrease from 17% to 12%,

- income tax threshold increased to PLN 30 thousand.

- tax threshold increased to PLN 120 thousand.

In the time of Russian aggression on Ukraine and the energy crisis, the government helps millions of Polish families. This includes, among others, solutions under the Government Anti-Inflation Shield (active until the end of 2022), which reduce the following taxes:

- 0 percent of VAT tax rate on the basic food products (a decrease from 5 percent VAT),

- 0 percent of VAT tax rate on natural gas (a decrease from 23 percent, and since 1 February 2022 from 8 percent),

- 5 percent of VAT Tax rate on electrical power (a decrease from 23 percent),

- 5 percent of VAT tax rate on systemic heating (heating from radiators) (a decrease from 23 percent, and since 1 February 2022 from 8 percent),

- 8 percent of VAT tax rate on motor fuels (a decrease from 23 percent),

- 0 percent of VAT tax rate on fertilizers and some agents in support of agricultural production (a decrease from 8 percent VAT),

- excluding the sales of some motor fuels from sales tax,

- reducing the excuse duty on: electrical energy, specific motor fuels and light fuel oil – down to the minimum level at the EU.

Budget Law for 2023 – main assumptions

In the Budget Law for 2023:

- the state budget is prognosed to reach PLN 604.4 billion.

- state budget expenditures were planned for as much as PLN 669.4 billion

- the deficit in the state budget is going to amount to a maximum of PLN 65 billion

– Budgetary revenue is planned at the level of PLN 604.4 billion. This is an increase by PLN 105 billion in relation to the year prior, while compared to 2015 it is an increase by 110 percent – the Prime Minister informed.

Detailed information is available in the communicate after the meeting of the Council of Ministers.

Budgetary expenditures for 2023

The budget for 2023 secures funds required for the continuation of the current activities, the priority activities, as well as for the implementation of new ones.

Social programmes

The budget for 2023 secures funds required for the key social family support programmes. They include, among others, the Family 500+ Programme (40.2 billion in 2023), “Good Start” benefit (PLN 1.4 billion in 2023), as well as Family Care Capital (PLN 2.4 billion in 2023).

Adjustment of retirement pensions and the 13th pension

Adjustment of retirement pensions and benefits is provided for in the budget for 2023, beginning from 1 March 2023 (indicator at the level of 113.8 percent) and the 13th retirement pension.

– Since the very beginning, our government has been doing everything to respond to the needs of Polish citizens while maintaining our developed social policy, which was not present at the time of our predecessors – i.e., the programme Family 500+, school layette, free medicine for persons over 75 years of age, additional retirement pensions, as well as high adjustments of pensions – we intend to keep all that – the head of government assured.

Defence

The budget also assumes increasing the financing of the defensive need of Poland from 2.2 percent of the GDP to 3 percent of the GDP. In 2015, defence expenditure equalled PLN 31.7 billion, in 2023 they are planned at the level of PLN 97.4 billion.

– Due to the public finance sustainability, we now have the possibility to significantly strengthen the army and recruit new soldiers. We are planning to recruit over 20 thousand soldiers in the next years, without even taking Territorial Defence Forces into account. This is also included in the budget – the Prime Minister added.

Health protection

The budget for 2023 assumes an increase of outlays for financing health care to over 6 percent GDP. In 2015, the expenditures on health protection amounted to approximately PLN 78 billion. We are planning that it is going to increase to approximately PLN 165 billion in 2023.

– When we were taking the government over in 2015, at the end of the year the expenditures on health service amounted to approximately 4.5 percent of the GDP at the time. In the next year, in 2023 they are going to exceed 6 percentage points which we have promised. We promised to achieve 6 percent to GDP counted in accordance with the statutory method, which has been in force for years. We are going to achieve that goal, and even exceed it at the level of approximately 6.2-6.3 percent to GDP – assured Prime Minister Morawiecki.

Other expenditures:

The following are also going to be included in the budget for 2023:

- an increase in the salaries in the government budget at the level of 7.8%,

- an increase in the salaries of teachers at the level of 7.8%, (with a concurrent increase in the education subsidy by PLN 8 million compared to the budget for 2022) – beginning on 1 January 2023 (after the increase in May of 2022 by 4.4% for all, and 20% for the teachers with the lowest income from 1 September 2022),

- financing tasks in the area of agriculture, including subsidies for insuring farming, farm animals, counteracting communicable diseases in animal and subsidies for agricultural fuel.